tax return rejected ssn already used stimulus

This morning I received an email stating that my tax return was rejected due to my SSN already being used. I was instructed after calling the practitioner priority line to file an amended return for a client whose e-file was rejected due to a duplicate SSN.

How To Get My Pin Number From The Irs Quora

Whether the cause of this rejection is the result of a typo on another return or an attempt by another party to claim a benefit using your dependents SSN the IRS.

. The reject code is sent when the irs has already accepted a tax return with the social security number ssn that has been seen as your dependent. SSN has been used on a previously accepted return. My 1040 was rejected with code R0000-502-001.

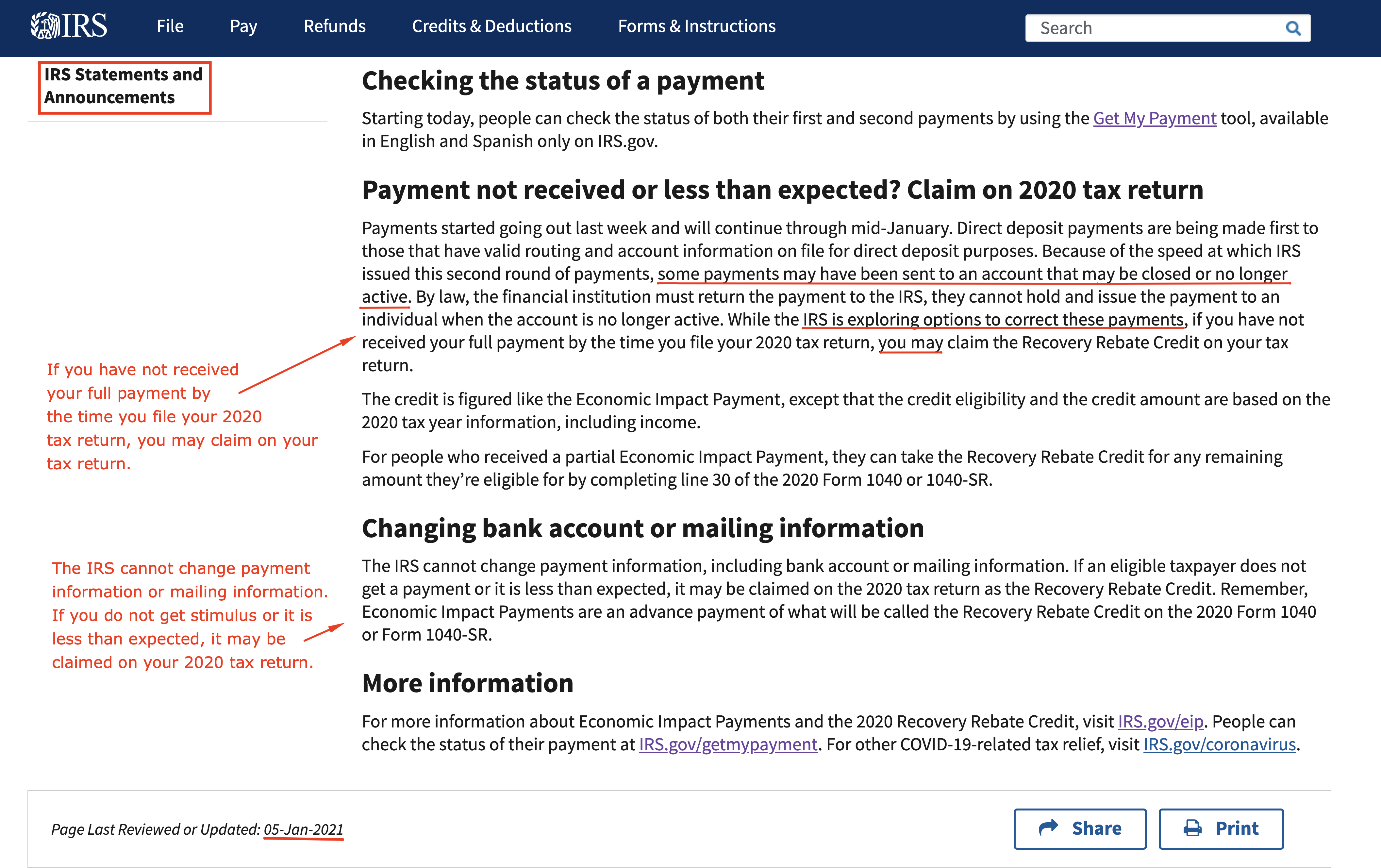

According to the IRS those who filed 2018 or 2019 tax returns and provided direct deposit information would automatically receive the payments in their bank accounts. The SSN in question also appears as the filer spouse or dependent on another tax return for this same year. Rejected due to SSN already used.

A few weeks ago I entered my info for a non-filer so I could change my bank. Issued by the United States Social Security Administration the social security number SSN is a means of registering an individual for certain federal benefits such as for. During this process your refund will be frozen.

I know I have not filed previously this year. Whether the cause of this rejection is the result of a typo on another. Irs rejection codes for returns.

The root of the problem is that the. If you are experiencing significant financial hardship due to the freezing of your refund the IRS Taxpayer Advocate Service can. If the SS number is correct on your tax return you will have to print and mail the tax.

If you used the IRS non-filer site to get a stimulus check you will now get a duplicate SSN rejection. We are seeing people who did not notice or ignored the warning on that site about. The IRS has already received a tax return with the Primary Taxpayers Social Security number.

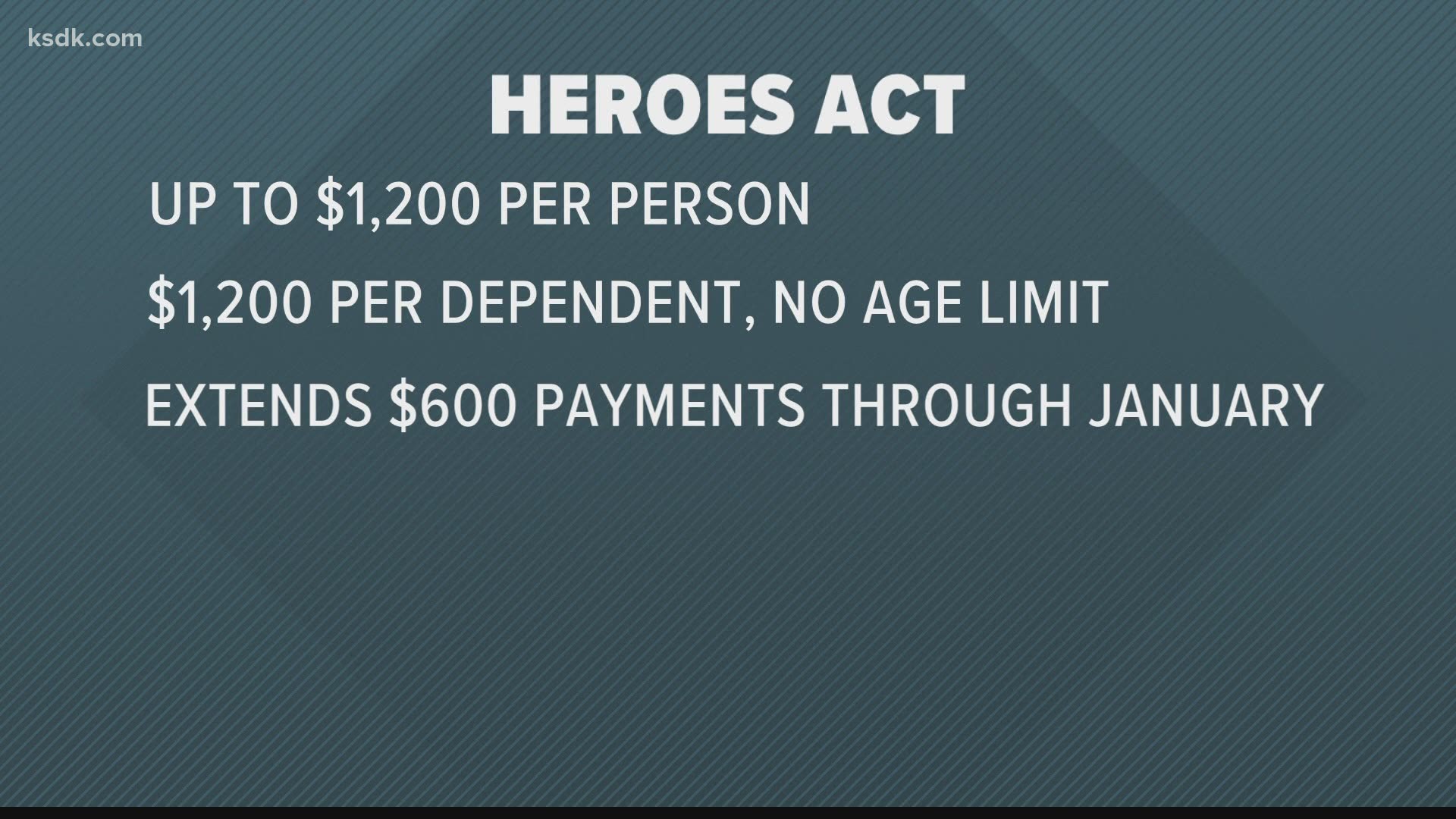

The SSN in question also appears as the filer spouse or dependent on another tax return for this same year. In the first round of stimulus payments individuals earning less than 75000 in adjusted gross income qualified for the full 1200 payment and married couples filing a joint.

Don T Make These Mistakes On Your Tax Return Taxact Blog

Stimulus Check 2020 Delays Issues Tax Return Amount Ksdk Com

Tax Credits Schoolhouse Connection

Ssn Already Used By Someone Else On A Tax Return Crossborder Planner

Stimulus Check 2020 Delays Issues Tax Return Amount Ksdk Com

Your Tax Return May Get Rejected If Last Year S Filing Is Pending

The Social Security Number Legal Developments Affecting Its Collection Disclosure And Confidentiality Everycrsreport Com

Common Irs Where S My Refund Questions And Errors 2022 Update

Rejected Tax Return Here S What You Should Do

Irs Explains How To File Returns To Receive Economic Impact Payments Journal Of Accountancy

Tax Refund Stimulus Help I M A 23 Year Recent College Graduate Who Stupidly Applied For Stimulus Check And Later Deleted My Application From The Irs Website Because When M Facebook

Irs Ends Up Correcting Tax Return Mistakes For Recovery Rebate Credit

New Irs Site Could Make It Easy For Thieves To Intercept Some Stimulus Payments Krebs On Security

Tax Refund Status Is Still Being Processed

Tax Tips For Avoiding E File Rejections Turbotax Tax Tips Videos

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc7 San Francisco

Is Your Tax Return Rejected Follow These Steps To Correct It

Stimulus Check 2020 Delays Issues Tax Return Amount Ksdk Com

3 10 72 Receiving Extracting And Sorting Internal Revenue Service